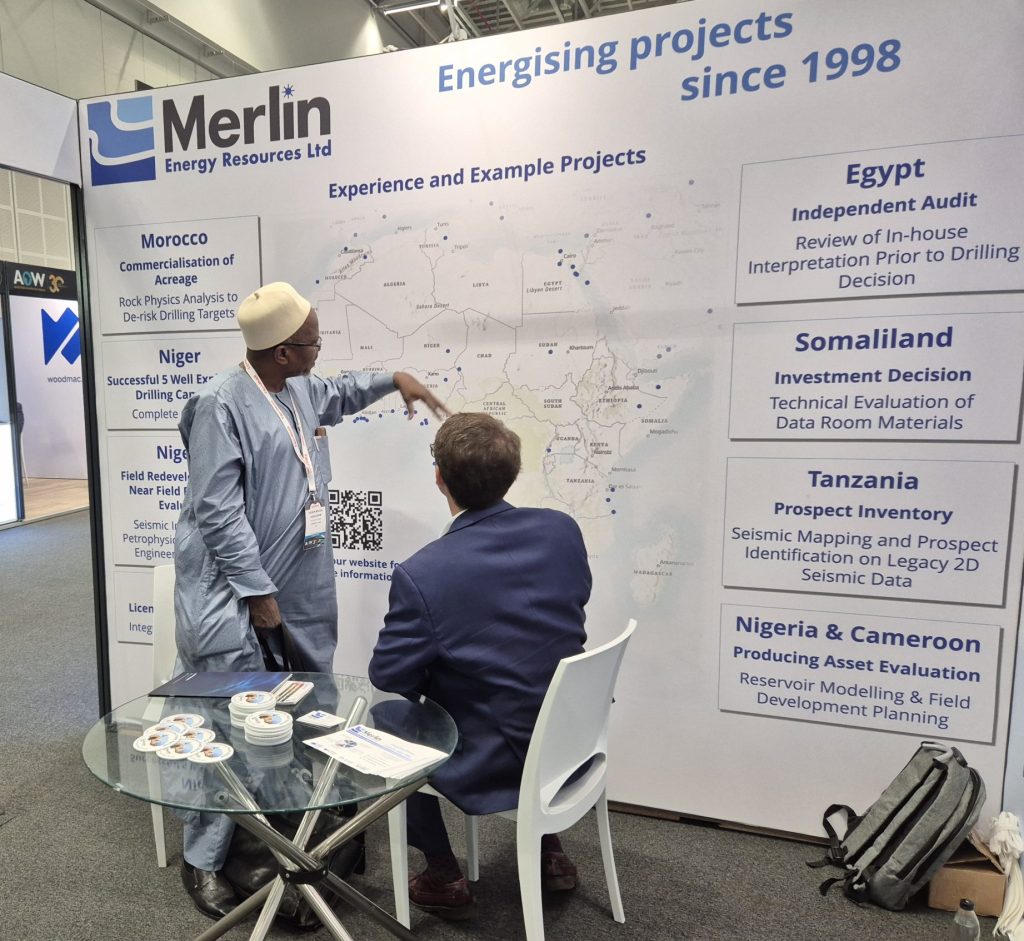

Having worked for many years across Africa, both for AIM-listed companies and indigenous African companies, Merlin took the opportunity to bring a booth to the AOW in Cape Town, mindful of the fact that it may be the last run of this conference in its current format. The aim was to engage with a community beyond Merlin’s usual network and better connect with the beating heart of Africa. Africa Oil Week did not disappoint!

The show offered a great opportunity to network, both at the Merlin stand and at the daily evening social events. Thanks to all who made the event so enjoyable by being so willing to chat!

The show offered a great opportunity to engage with the burning issues that frame the entire energy discussion across the continent, and these were superbly revealed through a series of top-class panel discussions. The meaning of these sessions was elevated because many involved Africans talking about Africa, not just an external perspective! So, what were some of the key issues?

Access to Energy

Much of the global growth in population in the decades to come will be in Africa, yet a minority of its population has access to energy right now. Many talks and discussions considered how this could be addressed, against a backdrop of climate change and the need for a ‘just transition’. It was widely acknowledged that the oil and gas sector must be sustained, to support African economies. However, one clear theme is that gas has come to the forefront as a transition fuel, most notably with the rise of major gas projects in Mozambique and Tanzania, involving export of energy both via LNG and intra-African distribution networks. African banks clearly value gas highly, as long as the offtake route can be proven, and its value to the local communities (the ‘S’ in ESG) is a significant focus for them. If gas can replace coal as an energy source, then a major step forward in CO2 emissions can be achieved for Sub-Saharan Africa.

Renewables

There were multiple talks and panel discussions which addressed this topic both from the issue of emissions reduction of traditional energy sources (oil, gas and coal) and green energy solutions (wind, solar, nuclear and geothermal). Geothermal opportunities were a key part of that, highlighting the progress being made in technology in this baseline energy source. These developments have reduced the temperatures at which electricity can be generated from thermal sources, thus expanding the potential footprint of the play. Estimated geothermal potential for East Africa is 16 GW with the remainder of Africa having a further 10 GW potential.

South Africa was discussed as a potential hot-spot for green hydrogen, allied to wind and solar, due to the abundance of land and water supplies. Combined with a push for gas exploration onshore, there could be a take off of activity in the region.

Activity and Investment

Africa has clearly seen the benefit of big exploration successes in Cote D’Ivoire and Namibia, with a resurgence seen in recent drilling activities. The majors have taken a lead in this respect, although it was acknowledged that small and mid-cap companies are an essential part of the community, often taking the first steps with novel and bold play concepts. Onshore Namibia is a good example of that, with nimble explorers Monitor Exploration and Recon Africa chasing a Neoproterozoic play, which is a possible analogue to the ancient petroleum system of Oman (known well to Merlin). Why not?

M&A activity in Africa tends to focus on mature basins, but the time to deal completion in Africa is apparently an impediment (reportedly averaging 30 months) as it erodes asset value and causes ‘bank fatigue’ (a new term for us!).

Regarding investment, whilst the ‘green shoots’ of recovery are there to be seen, investors are clearly very selective in capital allocation on African projects. The M&A hold-ups mentioned above, together with a perceived lack of impetus with some regulators, reduces investor confidence in some jurisdictions. It is clear that investment dollars have to stack up against other regions of the globe, with South America highlighted as a current focus. Investors want to see short term payback (of course), clear visibility on offtake and a tick in the ESG boxes, most definitely including environment and local content. Some African countries are streamlining processes to attract investment, whilst improving fiscal terms. Namibia is a clear example of that. There is also a noticeable push towards open-door licensing, rather than protracted and inflexible licence rounds. Times are changing!

From Merlin’s perspective, the big gap to be filled is with small to medium cap operators – the ‘little mushrooms’ of the E&P world. This part of the demographic is clearly lacking in numbers, and it is not completely clear whether replenishment is coming soon, by way of short-term investment. Given that M&A activity is expected to continue apace, how many mushrooms will be left in the field in the mid-term to take advantage of portfolios that have been shed by majors?

It was not all hard work though and the evening events were a good opportunity to network in a more relaxed environment over a glass of superb South African wine and some fabulous African cuisine. Cheers to all those who we met over the week and for those we didn’t, there’s always next time.